Home Energy Water Work Economy Solution Politics Team Product Recycling Cars Ships Aircrafts Promotion

World Pollution Air Weather Violence Women Weapons Psychology Plants Animals Food Peace Faith Imprint

Economy

The problem

Is very old; even Aristotle spoke negatively about it: Those with a lot of capital gain more and more through interest, and those with nothing have to earn this "more and more" for those who have it. In this way, capital increases automatically without the owners having to work for it. But since money can't multiply at all—I mean, money doesn't have sex and doesn't have children unless the central bank prints them—the work has to be done by those who can't collect money (for whatever reason), and they receive less and less money for their work, with constantly rising prices. As a result, the rich get richer and the poor get poorer. But let's take a closer look at the technical version of this statement:

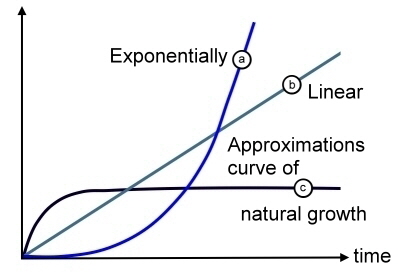

In our economies there are very different growth curves

a) the exponential growth, it grows like a disease like cancer for example. Also epidemics spread like that.

b) the linear growth, a small part of economists think that this solve our problems but that does also not work because the capital grows to fast too and we have:

c) the natural growth, almost everything natural in the world grows like this: trees eg growing until they are grown up, then they stop growing, That is the way it is on Earth.

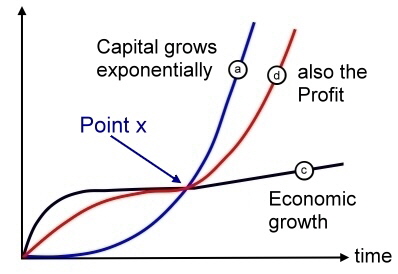

d) The profit must be decoupled from economic growth and grows therefore also exponentially.

Interest and yield describe the right of the individual who succeeded in saving, hoarding, withdrawing his financial surpluses, i.e. funds that he does not need to live, from the market and issuing them again as credit, but then, interest or, to charge a direct share of the borrower's profits, known as the rate of return.

Credit is both direct and indirect, and there are direct and indirect borrowers.

So the worker in a factory is actually an indirect borrower, the direct borrower is the factory owner who took out the loan from the bank. The bank is the direct lender and the customer of the bank who hoards his money there is the indirect lender.

Since the factory is also a stock company, there are even more direct lenders, namely the owners of the shares, the retirees who invest in a stock font are again indirect lenders. Here the direct lenders such as hedge fund managers earn money from the indirect lenders, in this example the pensioners.

All lenders, both direct and indirect, are now earning a share of the factory's products. In the form of interest or returns.

The direct and indirect borrowers have to pay for this from what they earn through their work. Ultimately, however, the profit must be constantly increased by the exponential increase in capital, since more and more has to be paid to the lenders. The first sign of this mismanagement is inflation. This describes the attempt by the factory owners to raise prices to meet the ever-increasing profit needs of the lenders. The immediate response of workers to offset this with wage increases eventually leads to runaway inflation.

But it still works relatively well as long as there is an immediate need for goods, if the saturation point is reached, the so-called point X the things will went wrong. The system can now only be kept alive with measures. First, wages were cut, workers laid off and prices increased. It didn't work that way. New measures were invented. The financial crisis 2008/2009 was the first sign of that the new measures failing too.

- The low-wage sector by mostly foreign workers or as in Germany by Hartz IV, the unemployed are forced to work below standard to work for little money. In the US, family breadwinners often have to hold two jobs...

- Outsourcing of work to countries with no labor protections and low wages with little or no environmental protection regulations

- Artificial reduction in the lifespan of the products or constantly new systems and/or an end to support from hardware and software companies... lousy product qualities with short lifespans

- Merciless contamination of the environment in which we live through exhaust gases and toxins from production, means of transport, plant cultivation and factory farming...

- Large-scale deforestation for monocultures or animal husbandry

- Consumption of important groundwater resources for these monocultures or animal husbandry

- Exploitation of raw materials in oceans on the seabed in protected areas, often by poor people and children

- Consumption of important groundwater resources for precisely these exploitations of raw materials

Technical measures:

- Issuance of insufficiently funded credit and trading in such credit

- Lowering of one key interest rate to push normal savers into the stock exchanges

- Mass buying of bonds with printed money from the national banks

- Profit optimization through island companies and mass tax evasion through relocation of company headquarters to other countries where the money is not earned at all.

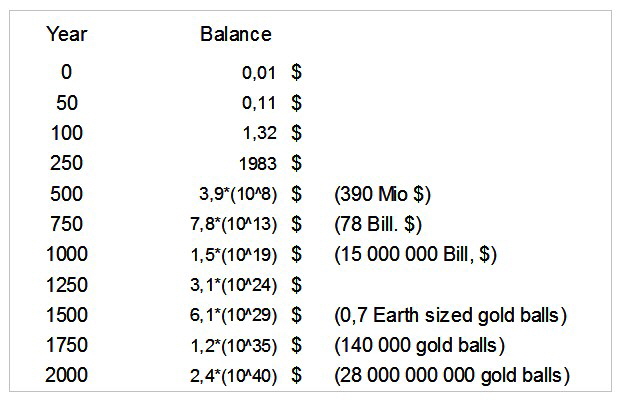

All these measures, of which there are many more, the ingenuity of the operators is really inexhaustible, are ultimately completely ineffective because the dynamics of interest and returns are so enormous that even a single cent becomes unaffordable over time.

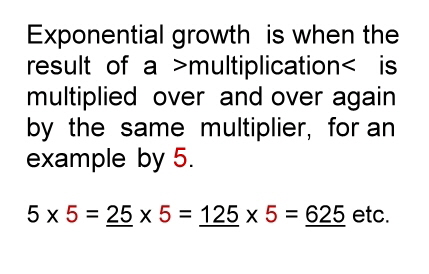

Explanation of the table

The Josephscent is a thought experiment by the British philosopher Richard Price that illustrates the enormous power of interest and compound interest over long investment periods, during which even the smallest sums can grow into astronomically large sums.

In the year 0 of the Christian era, Joseph invests one cent in a bank. This cent earns interest at an annual rate of 5%. The original amount plus all interest and compound interest is continually reinvested. Over time, the small cent grows slowly but accelerates exponentially. Compound interest ensures that the interest already accrued also generates interest. The statement of the Josephscent is the "miracle" of the compound interest effect. This example shows that even a small amount can lead to enormous wealth over a sufficiently long period of time. However, the higher the capital invested and the higher the interest, the return, or the dividend, the higher the payout and the faster the capital grows.

The Interest Calculation

For a capital of $100 earning interest at 5% per year, $1 = 1%, so 5% = $5, which is added to the $100, resulting in a capital of $105 in the first year. This doesn't sound like exponential growth at first. The next year, 1% of $105 = $1.05, and 5% equals 5.25. We add this to the existing $105 and now get $110.25. This doesn't seem like a hefty profit that tends toward infinity either. After the third year, it's $115.76, after 10 years it's $162.89, after 20 years it's $265.33, and after 30 years it's already $432.19. Now we can see the exponential growth. Now you might think that you can't exactly get rich with that, and why should something like that be dangerous? But let's approach the whole thing with 1 million:

Summary of the amounts:

After 1 year: $1,050,000, after 2 years: $1,102,500, after 3 years: $1,157,625, after 10 years: $1,628,895, after 20 years: $3,386,354, and after 30 years: $4,321,942.

The formula for this is: Kn = K0 * (1+p/100)n, where K0 is the initial capital, p is the annual interest rate in percent, and n is the number of years.

Assuming a capital of $5 billion, with a constant interest rate of 5%, we would have $21,609,710,000 after 30 years, with an additional $250 million in the first year.

A good trader can generate returns of between 10 and 30 percent per year with a portfolio. This could result in profits of up to $1.5 billion in the first year and after thirty years a total capital of $34,175,295,000,000, which is 34 trillion, one hundred seventy-five billion, two hundred ninety-five million. The capital would thus have increased almost sevenfold, and that is the worrying aspect of this type of employment.

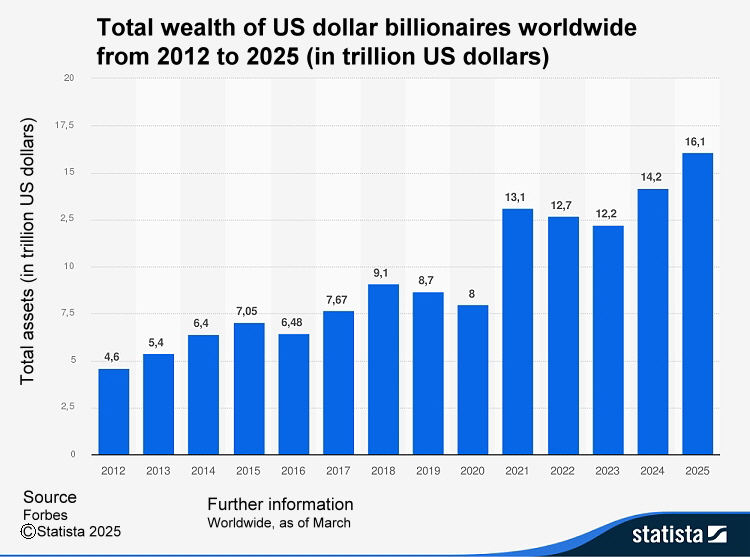

In 2025, the total wealth of all billionaires in the world was $16.1 trillion, a new record high. This data comes from a Forbes census published by Statista in April 2025. Except for a few setbacks, global capital is growing exponentially. The number of billionaires: just 3,028 in 2025.

Following this calculation, we are now at the point where the function transitions from an increasing arc to a steeply rising line. Wealth has nearly quadrupled since 2012, and this has happened in just thirteen years. Imagine what will happen in the next twenty-five years, up to 2050.

However, it is questionable whether there will be a wave of capital appreciation, because we are already seeing that the markets are stagnating and economic wars are emerging. Despite all the improvements in efficiency and production, all these goods still have to be sold, and they are already lying around in the Atacama Desert. The ever-increasing unemployment figures expected as a result of artificial intelligence also force the question: Who will buy all these goods and services in the future?

This is the inner defect of capitalism

We must finally recognize this. The main reason why my statistics have always been correct over the years is that I always fully included this defect and its effects in my calculations and did not indulge in various fantasies like others. You can only exploit this imbalance as long as it runs and hold it at life it as much as possible. Raising and lowering the key interest rate is not a solution either, it only means that poorer people who want to save a small safety cushion can no longer do so. These, as well as pensioners, for example, are being pushed into the stock exchanges and thus contribute to uninhibited economic production. Ultra-loose monetary policy is only fueling more debt and central bank bond purchases are fueling inflation. The whole system was hit so hard again in 2019 that there was no year-end rally. The smallest disruption in such a phase immediately leads to galloping inflation. First in Turkey, then in almost all southern European countries and finally also in Germany and the USA. The war in the Ukraine is of course contributing to the rapid loss of purchasing power in Europe, especially since everyone is now trying to raise their prices quickly in order to be able to cash in properly in advance. This new, relatively large war is ultimately just also a consequence of capitalism and will contribute significantly to the surface warming of the earth. The signs of war was starting between the USA and China when Donald Trump was President, because an economi war are the first signs. Although the eastward enlargement of NATO could hardly be avoided, because the Eastern European countries were dying to escape the social dictatorship of the Soviet Union and to be integrated into the wonderful consumption of the West, it was fundamentally wrong, but makes it clear once again that with capitalism war is also inevitable, because the arms dealers always want a piece of the pie and usually not a small one. It is wrong to name the war as the culprit for the economic problems, because there is currently no war in the USA, but a blatant economic and social imbalance, even before the corona virus.

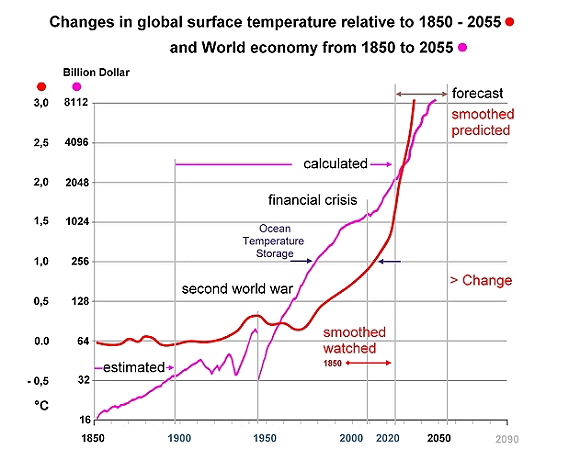

Ultimately, the uncompromising mass production of inferior products cause a global earth surface heating. The costs of the resulting disasters will negate all gains.

We're obviously making mistake after mistake trying to run a system that can't possibly work. The biggest mistake, however, was probably trying to compensate for economic growth through overproduction and mass consumption via advertising. The end result is surface warming that will threaten all of our survival on the planet. The graph above is intended to illustrate how the increased economic growth affects the surface warming of the earth. I developed this graph from the social, environmental and economic reports of the countries and the new environmental report of the IPCC from 2021 as well as the calculations and forecasts about the economic growth of various banks. When the two characteristic curves were put together, there was a frightening correlation that leaves no hope for improvement. This calculation suggests that surface warming will take on a momentum of its own by 2050 that can no longer be stopped. Well, ultimately this is also to be seen in the context of certain commandments. How was that again? Overindulge is a mortal sin? We could argue about matters of faith here, but we can't help but admit that this rule was created for good reason. And that now that we clearly see cause and effect, it's pretty anti-social to just keep going and postpone the right measures until later when our children have to deal with what we, in almost 200 years, have done.

To the top ![]()

![]()

![]()

Home Energy Water Work Economy Solution Politics Team Product Recycling Cars Ships Aircrafts Promotion

World Pollution Air Weather Violence Women Weapons Psychology Plants Animals Food Peace Faith Imprint